[vc_row][vc_column][vc_column_text]An uncertain economic climate, 6.2%* inflation and an energy crisis that is pushing up bills: the purchasing power of the French is at an all-time low. This crisis situation is benefiting discount chains, and in particular the three trendy chains from Denmark: Normal, Flying Tiger and Sostrene Grene!

How are these three chains gaining market share from their French rivals Gifi, Stockomani and la Foir'Fouille? [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

Danish discount in France

[/vc_column_text][vc_row_inner content_placement=”middle”][vc_column_inner width=”2/3″][vc_column_text]

Normal

Founded in 2013 in Denmark, soften callede the IKEA of discount bazaars, lt Normal ("normal products, abnormal prices"), arrived in France in 2019, at Passage du Havre in Paris. Since then, it has counted 78 stores in France (> 400 across Europe).

[/vc_column_text][/vc_column_inner][vc_column_inner width=”1/3″][vc_single_image image=”17476″ img_size=”large” alignment=”center”][/vc_column_inner][/vc_row_inner][vc_row_inner content_placement=”middle”][vc_column_inner width=”1/3″][vc_single_image image=”17475″ img_size=”full” alignment=”center”][/vc_column_inner][vc_column_inner width=”2/3″][vc_column_text]

Sostrene Grene

"Les Sœurs Grene" in French, fondée en 1973 pby two sisters of the same name in Denmarkis a chain ofresentin France since 2014 through 40 stores (present in 16 countries Europe and Asia). [/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner content_placement="middle"][vc_column_inner width="2/3″][vc_column_text]

Flying Tiger

Founded in Copenhagen in 1995, the original name "Tiger" is a play on the sound of "Tier", a Danish slang word meaning 10 kroner, the unit price of many of the products sold. Present in France since 2014it today has 31 French stores (> 30 countries around the world). [/vc_column_text][/vc_column_inner][vc_column_inner width="1/3″][vc_single_image image="17474″ img_size="full" alignment="center"][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

A common strategy

Inspiration: the giant Ikea

The first thing the three brands have in common is their country of origin: Denmark. All three are known for their pastel stores, playful POP that combines Nordic minimalism with a touch of fun, and classical or pop music. Like most Northern European brands, notably the giant IKEA, the stores of all three brands are organized intoThis encourages compulsive shopping and ensures that visitors rarely, if ever, leave empty-handed.

The Tik Tok phenomenon

The three banners have mastered visuals, trendy products at affordable prices, and 2.0 communication.. In this respect, social networks, and TikTok in particular, are our three discounters' best allies: The three chains have more than 200K followers followers on this network, compared with just 83K for the three French chains.

Their strength lies in the videos shared by consumers on the networks: videos signed by the powerful #haul** hashtag such as #normalhauls** (35.6M views) #flyingtigerhaul** (3.3M views) and #sostrenegrenehaul** (413K views), which go viral and provide strong, free promotion for brands. Example post/video

Our Danes put trendy products on sale on the networks, such as the famous pink cleaning paste "The Pink Stuff", which will be very popular on TikTok in 2021. This cleaning product was unavailable on the national market, and Normal was one of the first to market it in France.

On their respective networks, they share simple, captivating DIY (Do It Yourself) projects using products sold locally, and quickly go viral. Visit new collections are presented every week on the various networks, through short, highly aesthetic and trendy videos.

The three brands are pursuing a social network communication strategyand never run TV spots. This enables them to remain competitive and strengthen their E-reputation, particularly among their target population of young people.

Hyper-centre access to their target market

Another strong point in common between the three brands, and not the least, is their strategic hypercentre location. strategic hyper-centre location. Unlike competitors such as La Foir'fouille or Stockomani, our Danes are located in the heart of the city, in large shopping arcades. In Paris, Normal is in the Saint-Michel district, and Sotrene Grene in the Forum des Halles, right next to Flying Tiger. This geolocation makes these chains more accessible and therefore more competitive, revitalizing and rejuvenating the image of discount.

Its Dutch counterpart, Action, has also grasped the nettle, opening its stores in city centers with great fanfare, and has enjoyed a meteoric rise since opening its first store in France in 2012: soon to be 700 stores, France's 3rd favorite retailer*** in 2022! [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

Omnichannel is almost non-existent:

While Sostrene Grene and Flying tiger already have e-commerce sites and offer their customers the possibility of placing orders online, Normal, and the majority of competing brands, are content with storefront websites. In the digital age, and above all in the omnichannel age, it's urgent for these brands to adapt their strategy to face up to the e-commerce giants and survive in a highly competitive market.

Action, for example, launched its application last month with a range of services (personalized product suggestions, digital loyalty card and receipt, product scanning, etc.). [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

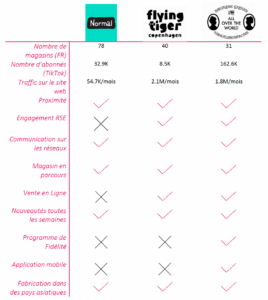

Comparison table :

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

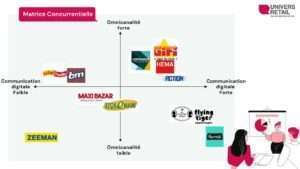

Positioning map / Competitive mapping

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]In conclusion, the three Danish companies have :

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]In conclusion, the three Danish companies have :

- Reinventing discount by locating in city centers and busy shopping malls

- Mastering 2.0 communication

- Focus on visual appealWe're all about visual appeal, in our stores, on our websites and on our networks. Design and aesthetics straight out of the Nordic countries, cradle of the minimalist, uncluttered style at the cutting edge of the trend.

Although these chains have perfectly mastered the new discount image, and their avant-gardism has enabled them to achieve strong growth on the French market, they will have to and offer an omnichannel customer experienceThis will enable them to strengthen their position in the European discount market.

For our French discounters, even though they are well established in the minds of French consumers, the challenge is to keep up with the current trend towards modernization of sales outlets while maintaining their discounter image (and prices!). Challenges that the French giants are ready to take up:

à Gifi with Horizon 2027Gifi's goal is to reach 1,000 stores (vs. 580 today), with more and more openings in city centers following the opening of the first Gifi Paris store in 2016 and the acquisition of the Tati chain.

à Foir'fouille with its plans for a larger store (+50% surface area), a more "chic" decor (without affecting product prices, which will remain low) and above all a U-shaped organization organization to enhance the customer experience and encourage impulse buying.

*According to the consumer price index (CPI) measured by INSEE.

** Hauls videos: are videos in which a youtuber/influencer shows, comments on and sometimes tries out his or her purchases.

*** according to the EY Parthenon study [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Sources

Sostrene Grene[/vc_column_text][/vc_column][/vc_row]